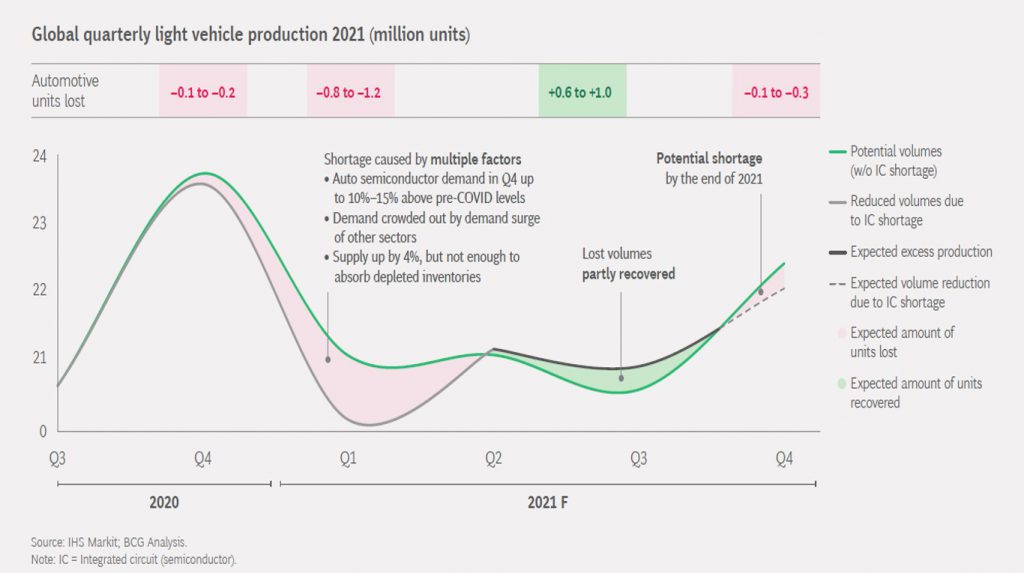

#Automotive #semiconductor shortage is here to stay in the near future, esp 2021. The hard reality is that expected loss in production volume of cars in Q1 ’21 itself is upto 1.2mil units (Source: #BCG). Reason: a semicon demand rise across sectors with inadequate supply growth.

Auto accounts for only 10% of semiconductor sales & is facing the heat of massive supply disruptions due to crowding out by demand surge across #PCs/#smartphone/#IT & #communication #infrastructure segments. While capacity expansions have begun, it is likely to take time to bring more volumes online.

For auto players, the time to act is NOW! They will need to act proactively with a sense of urgency to counter these shortages & minimize production losses. Their need to stand out & be noticed in the crowd will require improvised approaches as in #communication industry. Custom #chip making at tech giants as #Apple (M1), #Google, #Amazon, #Microsoft has exploded for better performance + #supplychain control + supply continuity via direct supplier relationships & long term contracts with modified terms (min. order/price/premium/technical engagement etc.).

Seeking these advantages can lead auto industry too in the direction of rethinking relationships with its technology suppliers.